Radar | Feb 03,2024

May 24 , 2025

By Kevin P. Gallagher , Jose A. Ocampo and Kunal Sen

Economists have long criticised the Debt Sustainability Framework (DSF) for its inadequacies. While it attempts to balance financing needs with debt sustainability, it inadvertently limits public spending and investment, often exacerbating economic distress. In this commentary provided by Project Syndicate (PS), Kevin P. Gallagher, professor of Global Development Policy at Boston University, Jose A. Ocampo, a professor at Columbia University, and Kunal Sen, a professor of Economics at the University of Manchester, argue in favour of reform to transform this framework from a debt reduction tool to an enabler of growth-oriented investments.

A slowing global economy, rising trade tensions, and increased risks of recession could mean a perfect storm for low- and middle-income countries (LMICs) burdened by high sovereign debt. Faced with exorbitant borrowing costs and an increasingly jittery international environment, these countries' potential for economic growth and development will be severely curtailed.

Given the circumstances, the current international financial architecture, particularly its approach to debt sustainability, needs to be overhauled. Only by embracing a new approach to developing-country debt will these countries be able to generate the investment flows they so desperately need to kickstart long-term growth.

The concept of debt sustainability remains heavily influenced by the International Monetary Fund (IMF)-World Bank Debt Sustainability Framework, even though economists within both institutions have long recognised the DSF's inadequacies. It is supposed to balance the need for development financing with debt sustainability, but it often advocates suboptimal levels of government spending and investment, inadvertently contributing to future economic distress in developing countries.

It also frequently fails to account for the scale of investment required, and it is insufficiently sensitive to economic and external shocks.

The DSF has historically overstated the potential of fiscal consolidation to spur economic growth, leading to persistent forecast errors and higher-than-anticipated debt ratios. One critical flaw is its limited consideration of the long-term benefits of debt-financed investments, particularly in areas like the green transition. The framework needs to evolve from a tool focused on debt reduction at all costs to one that incentivises investments designed to drive future growth and long-term fiscal sustainability.

We are already seeing some advanced economies, such as Germany, moving beyond their debt ceilings to increase public spending on defence and other urgent needs. Policymakers in these countries understand that borrowing to fund government consumption is fundamentally different from making strategic investments in infrastructure or climate adaptation, which can offset future economic losses and bolster debt sustainability over time.

Similarly, lending decisions for LMICs should be based on long-term models of debt sustainability, not simplistic rules-of-thumb like countries' debt-to-GDP ratio. Achieving debt sustainability is more likely if adjustment programs facilitate high investment since this can underpin stronger economic growth. Investment-driven borrowing, when managed effectively, has been linked to low sovereign debt risks and should, therefore, be encouraged.

Of course, the most immediate issue is the large debt overhang many LMICs face. Past successful interventions have already shown that debt relief, deep reductions or suspensions of interest payments, cuts to charges and surcharges on credit, and increases in grant allocations and available special drawing rights (SDRs, the IMF's reserve asset) should all be on the table.

But, addressing LMICs' long-term financing needs requires broader reforms. A major boost in long-term, low-cost financing is essential. Multilateral development banks and international development finance institutions can and should play a central role in gradually increasing affordable lending. They are the only ones who can provide countercyclical lending when private financing is limited, commodity prices are falling, or the global economy is in crisis.

We need more initiatives like the African Development Bank's African Development Fund, which provides concessional funding, grants, project preparation resources, and guarantees for low-income regional members.

The current conception of debt sustainability for LMICs is based on a fallacy that hinders global growth and sustainable development. We should move from a narrow focus on debt reduction to a broader understanding of debt sustainability that focuses on long-term investment-driven growth.

By rethinking debt sustainability, the international community can empower LMICs to embark on a path of sustained economic development. A bold reimagining of the international financial architecture is imperative to avert prolonged debt crises, restore fiscal sustainability, and ensure global economic stability.

The Fourth UN International Conference on Financing for Development, which will take place in Seville, Spain, in July, will give developing countries an opportunity to speak with one voice to the Western-backed institutions that oversee the current international financial architecture. These institutions hold the key to unlocking developing countries' shackles of unsustainable debt and bringing about the systemic changes that could revolutionise development finance.

PUBLISHED ON

May 24,2025 [ VOL

26 , NO

1308]

Radar | Feb 03,2024

Radar | Jul 03,2022

Viewpoints | Sep 10,2023

Commentaries | Jan 16,2021

Agenda | Sep 08,2024

Agenda | Mar 23,2024

Fortune News | Feb 18,2024

Viewpoints | Nov 29,2020

Fortune News | Jan 14,2023

Featured | Sep 09,2024

My Opinion | 129529 Views | Aug 14,2021

My Opinion | 125835 Views | Aug 21,2021

My Opinion | 123847 Views | Sep 10,2021

My Opinion | 121652 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

May 24 , 2025

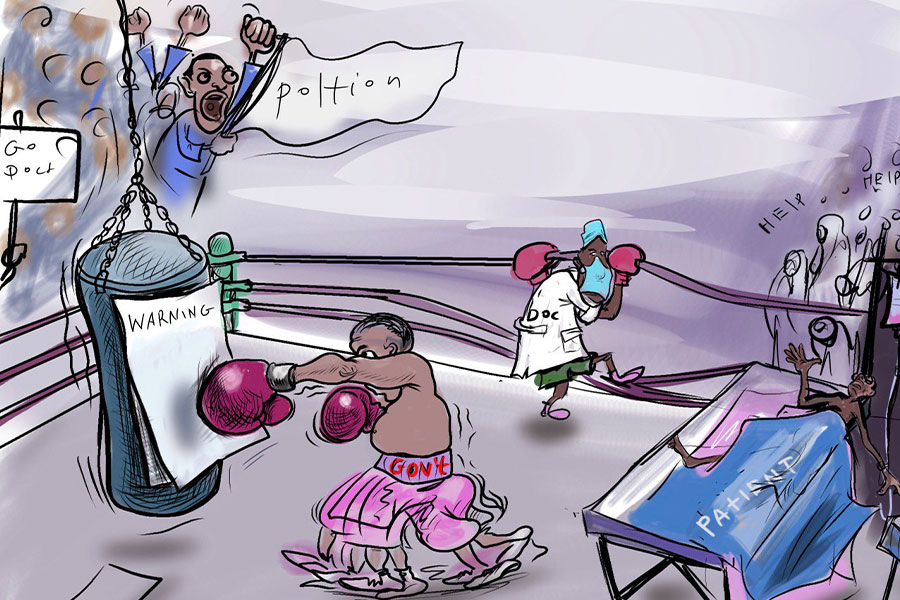

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...

May 10 , 2025

Federal legislators recently summoned Shiferaw Teklemariam (PhD), head of the Disaste...

May 3 , 2025

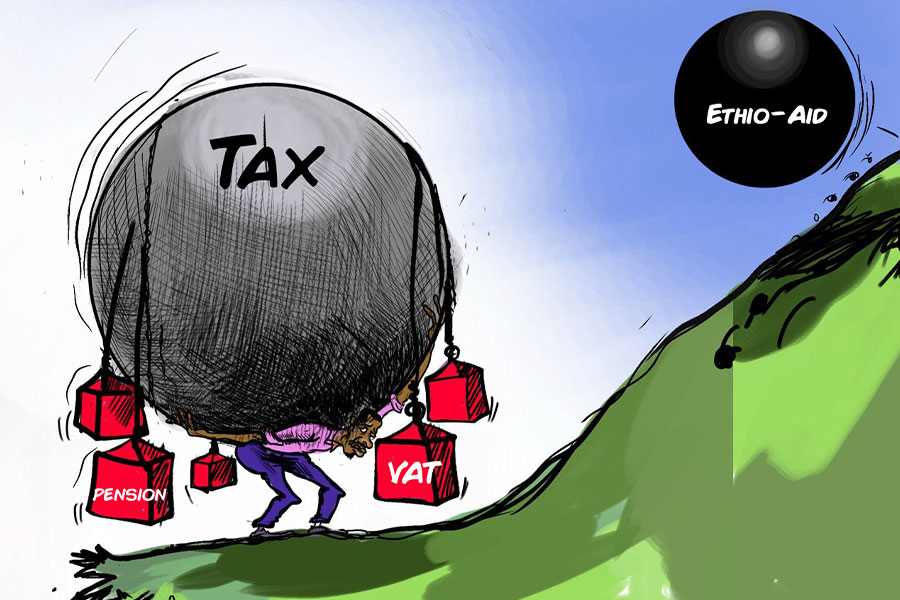

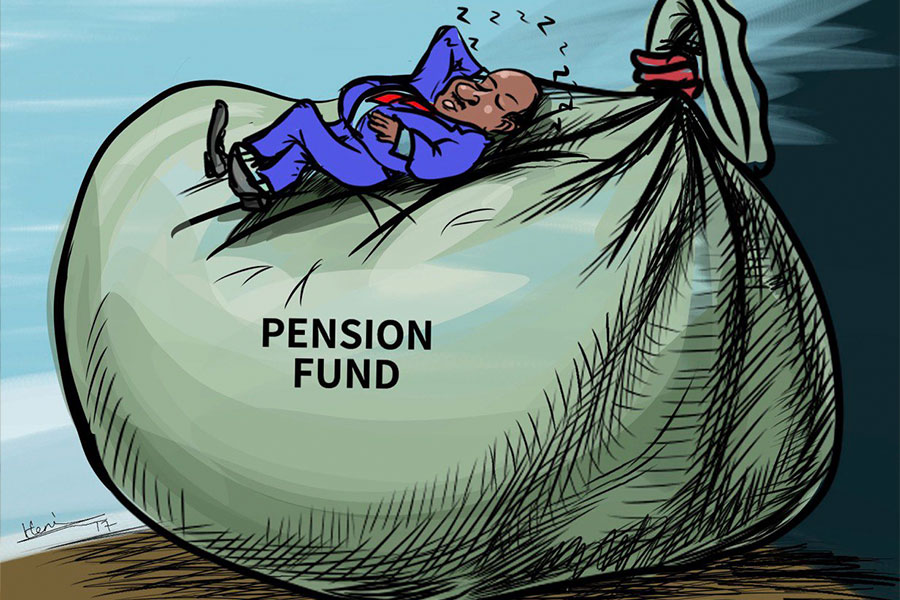

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...

May 24 , 2025

First came the trickle, then the torrent. On a humid night in late March, a low-lying neighbourhood on Addis Abeba's southeastern fringe wat...

May 24 , 2025 . By BEZAWIT HULUAGER

When Moses Akuei received his geology degree from Wolaita Sodo University, the 27-year-old from South Sud...

May 24 , 2025 . By BEZAWIT HULUAGER

The Central Bank is launching a sweeping initiative to overhaul the agricultural finance system, targetin...

May 24 , 2025 . By NAHOM AYELE

Federal legislators are considering a bill that would allow foreign nationals to lease land and own resid...